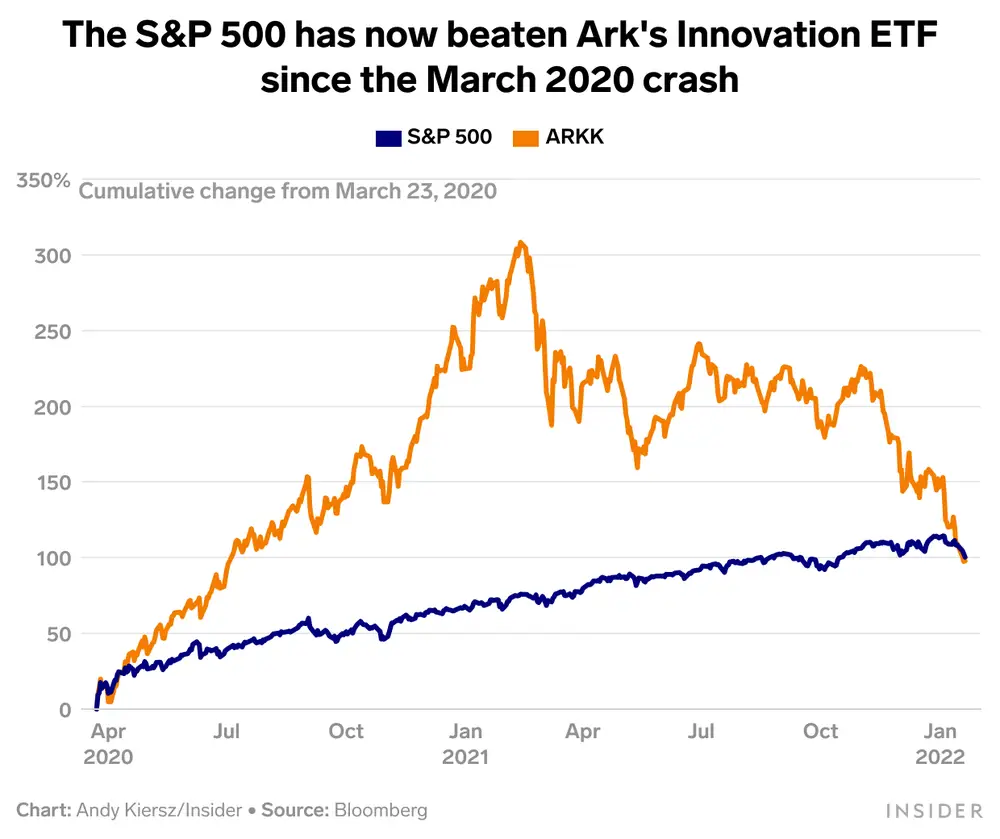

Cathie Wood’s ARK ETFs shot to fame right after the coronavirus pandemic when they returned 157% in the year 2020. Since then, however, they were down 23% in 2021 while in January 2022 alone, they are 27% in the red. With the economic outlook uncertain for growth stocks, the question remains whether diving into these funds at this point in time is a good idea or not.

A mistake in hindsight

Buying the ETFs late 2020 when they were at their all-time highs and when Cathie Wood was a hot property on social media was clearly a mistake in hindsight. As things settled down, so did the ETFs. But Ms. Wood is unfazed by the recent declines and outflows and has called on investors to remember that her investments have a long-term horizon, mostly a period of at least 5 years.

A good time to buy?

It is hard to feel confident investing in ARK ETFs right now as the economy doesn’t look favorable at all for growth stocks, something that has reflected in most growth stocks across the US market. But then again, ‘buy when others are fearful’ is a well-known saying and one that has proved fruitful for those who have been brave enough to pull it off in the past.

If you are an individual willing to take the risk, this might well be the perfect time to jump into these exciting ETFs. They contain names that not only have great potential but are also trading at heavy discounts, making them extremely attractive.

Tesla($TSLA), the biggest position of ARK Investments is down about 20% YTD. Zoom Video Communications (ZM) is down 22% while Teladoc Health (TDOC) is also struggling with 22% losses in January 2022.

These valuations are extremely attractive for investors who are willing to take the risk in order to hit it big in the coming years!