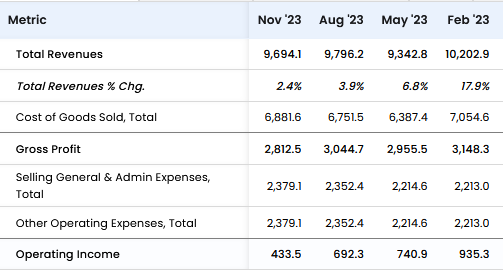

Dollar General Corporation’s Q3 earnings report is out and by the looks of it, the company has done a great job beating Wall Street expectations. It announced an EPS of $1.26($1.19 expected) and a revenue of $9.69 billion($9.64bn expected).

The company is facing challenges on two fronts.

Firstly, it is the slowing sales that are affecting their topline. The new CEO Todd Vasos, who was called out of retirement to steer the DG ship, has outlined some steps that he thinks will help the company improve its performance in the coming quarters.

Todd Vasos has decided to slow down new store openings while he works on improving the existing business. He intends to trim down the underperforming products in his stores and optimize inventory. This will allow the company to focus on the existing products that sell well.

Secondly, there has been a lot of criticism of the company over its working conditions. As things stand, the company owes OSHA $21 million in fines. While the monetary price is part of the business, the reputational damage this is causing hasn’t been well received by shareholders. The shareholders have already voted for an independent audit that should help the company identify and resolve this problem.

The above two issues will be the company’s priority heading into the holiday season. The repair work will take time and shareholders should not expect massive gains in the current economic environment. The stock has nearly halved this year and shareholders will be happy to accumulate shares in this range while they wait for the turnaround.