Johnson and Johnson ($JNJ) as an investment is often compared to a bond or other fixed-interest securities. As of Mar 2023, the company’s dividend yield stands at a healthy 2.95%. The share price has been relatively stable and has not dropped below $120 in the last five years.

Financials

Between 2020 and 2021, JNJ saw a 13.5% increase in revenue; in 2022, the company saw another 5% growth. A forward price-to-earnings ratio of 16X is higher than the historical sector average of 23X because the company expects adjusted earnings per share (“EPS”) of $10.65 to $10.75, an increase of nearly 10% year over year.

Thus, among the big US pharmaceutical companies, JNJ is probably the safest bet, though investors shouldn’t expect huge overnight gains because the company is too big.

JNJ’s net profit margin has increased to over 20% in recent years, and the company’s 8K filing shows that in Q222, on an adjusted basis, it was nearly 28%, with net earnings of $6.9 billion.

The company uses a smart data strategy to develop new pharmaceuticals and technology, which is incorporated into the company’s medical device division. Following the split of its pharmaceutical business into the consumer health segment and its medical technology business, JNJ goal is to grow to a $60 billion pharmaceutical company by 2025 on the strength of the continued success of its most valuable brands and the introduction of several new game-changing products.

Abiomed acquisition

Johnson & Johnson (NYSE: JNJ) finalized its purchase of Abiomed on December 22, 2022. (ABMD). J&J’s Medtech division has acquired Abiomed, a market leader in heart pump solutions. The decision to stop producing body powder contributed to a 5.49 percent increase in JNJ stock price year over year. Additionally, in 2023, with the help of the acquisition of Abiomed, J&J plans to split its consumer products brand from its pharmaceutical and medical technology business.

In terms of revenue growth, Abiomed’s Impella CP, a temporary mechanical cardiac assist device implanted percutaneously into the heart’s left ventricle, led the pack at 75% (YoY), followed by Impella 5.0/5.5 at 18%. (YoY).

The $35 CVR offer that is part of JNJ’s purchase of ABMD will become effective between 2028 and 2029. In other words, investors will have to wait nearly seven years to see a return on their money. Abiomed’s total revenue will not contribute to the $3.7 billion net sales milestone revenues. However, the company’s leadership seems confident that these targets can be met, as they are modernizing their business structure to better accommodate the growing demand for medical devices.

Diving deeper into the numbers

JNJ’s revenue for the third quarter of 2022 was $23.79 billion, an increase of 1.94 percent year over year and $357.93 million higher than expected by Wall Street analysts. But this was still down from the Q2 2022 total of $24.02 billion (-0.9%) year over year. Spending on R&D (year-on-year) also rose, this time by 5%, to $3.6 billion. As of the third quarter of 2022, it had invested in several new Medtech companies and spent 15.1% of its revenue on research and development for its pharmaceutical division.

In the third quarter of JNJ’s fiscal year 2022, sales from its Medtech franchise rose 2.1% to $6.782 billion. (YoY). In terms of percentage, the Medtech division contributed 28.5% of total revenue during the quarter. J&J needed to boost sales in this sector because it was the second-best-performing sector after consumer health and pharmaceuticals.

Sales of JNJ’s pharmaceuticals peaked at $39.4 billion in the nine months before October 2, 2022, while sales of consumer health products fell to $11.1 billion, a decrease of 1.1%. (YoY). The quarter’s highlights for J&J were its innovative pharmaceuticals, such as CAR-T medications and gene therapies, as well as its established pharmaceuticals and investigational pharmaceuticals. Pharmaceutical industry revenue reached $13.214 billion in Q3 2022, up 2.6% year-over-year from Q3 2021’s $12.882 billion.

Will the split be good for shareholders?

When I heard that JNJ would be splitting up in 2023, I was relieved to learn that the pharmaceutical division was the most lucrative. Due to the need to adapt and incorporate new technologies, I believe that linking consumer health and Medtech to pharmaceuticals will only lead to a drop in revenue. At least 14 new drugs with over $1 billion in sales potential will be introduced by J&J’s pharmaceutical division. Additionally, the firm estimates that sales of nearly half of these medicines can reach $5 billion or higher.

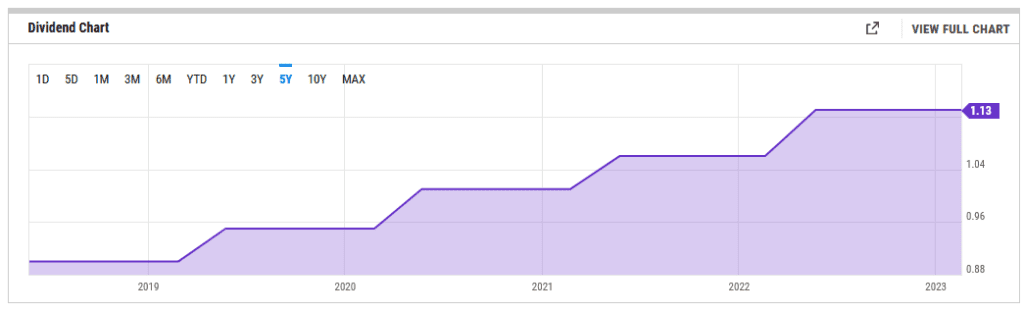

As was previously mentioned, JNJ’s medical technology and pharmaceuticals divisions have been more lucrative than its consumer health business. Kenvue, a proposed new company, would operate as JNJ’s fast-moving consumer goods division and contribute to preserving JNJ’s lean operations and nimbleness. The remaining part will focus on originality. What will happen to the dividend after the split is also unclear, as it currently has a forward yield of 2.95% and a dividend rate of $4.52 per share.

Sales of the COVID-19 vaccine, which have contributed to the Infectious Disease division’s 21% compound annual growth rate (CAGR) in revenue, will likely not last much beyond 2022, as pandemic pressures are expected to ease and the single shot vaccine has not been as widely adopted, which is bad for JNJ. Unlike Pfizer’s Comirnaty or Moderna’s (mRNA) SpikeVax, for instance, it is not likely to do well in a for-profit market.

Moreover, the cardiovascular division has seen a steady decrease in revenue. The patent for this medication will run out in 2024. Although J&J spent $30 billion to acquire this franchise when it acquired Actelion in 2017, both Uptravi and Osumit have successfully treated pulmonary hypertension.