Tesla, Inc. (TSLA) is one of the world’s most well-known electric vehicle (EV) manufacturers, with a market capitalization of $1 trillion as of March 2023.

Continuing its growth

Tesla’s revenue in 2021 was $59.04 billion, a significant increase from the $24.57 billion it earned in 2018, and the company expects continued growth as EV adoption continues to rise. It has a forward price-to-earnings ratio of 118.84X, significantly higher than the historical sector average of 23X, indicating high investor expectations for the company’s future earnings growth.

The company’s 5-year average revenue growth rate is an impressive 48.5%, with a projected growth rate of 57.4% in 2022.

Tesla’s gross profit margin has been steadily increasing, reaching 23.8% in 2021, up from 19.6% in 2020. The company’s net profit margin has also been improving, reaching 6.9% in 2021, compared to just 0.8% in 2019.

These trends are expected to continue, driven by growing economies of scale, lower production costs, and the introduction of new products, such as the Tesla Cybertruck and the Tesla Semi.

Tesla has been investing heavily in research and development (R&D), spending $1.68 billion in 2021 alone. The company has also been expanding its production capacity with new factories in China, Germany, and Texas, as well as plans for additional factories in other locations.

Tesla’s revenue for the twelve months ending December 31, 2022 was $81.462B, a 51.35% increase year-over-year. Tesla annual revenue for 2022 was $81.462B, a 51.35% increase from 2021. Tesla’s annual revenue for 2021 was $53.823B, a 70.67% increase from 2020.

Quarterly performance

Tesla’s revenue for the fourth quarter of 2022 was $17.23 billion, up 52.6% year over year and $780 million higher than expected by Wall Street analysts. The company’s automotive revenue was $14.27 billion, up 48% year over year, driven by strong sales of the Model Y and Model 3. Tesla’s energy generation and storage revenue was $2.94 billion, up 68% year over year, reflecting growing demand for its solar panels and Powerwall batteries.

In terms of geographic revenue breakdown, Tesla’s revenue from the United States and Canada was $8.35 billion, up 34% year over year, while its revenue from China was $5.57 billion, up 85% year over year. Tesla also saw strong revenue growth in Europe and other markets.

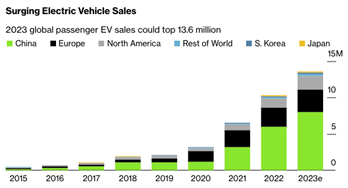

Surging electric vehicle sales

Tesla’s expanding product portfolio and growing revenue streams have led to a strong financial position, with $15.6 billion in cash and cash equivalents and $18.7 billion in long-term debt as of the end of 2022. The company has been generating positive free cash flow, with $2.8 billion in free cash flow in the fourth quarter of 2022 alone.

Upcoming challenges

Despite the company’s success, there are still challenges facing Tesla, such as supply chain disruptions and regulatory issues. Additionally, Tesla faces increasing competition from established automakers and new entrants in the EV market. However, Tesla’s strong brand recognition, innovative technology, and expanding production capacity make it well-positioned to continue its growth trajectory.

Issue for Consideration

One issue that investors should consider when investing in Tesla is the company’s valuation. With a forward price-to-earnings ratio of 118.84X, Tesla is trading at a significant premium to its peers in the auto industry. If the company fails to meet its high growth expectations, there could be a significant pullback in the stock price.

Tesla’s focus on innovation has also led to significant developments in autonomous driving technology. While the company has faced some setbacks with its autopilot system, Tesla remains at the forefront of this technology, with its full self-driving capabilities now available in beta.

Tesla’s stock price has been volatile, with significant fluctuations in recent years. However, the stock has continued to perform well, increasing by 78% in 2021 alone. As of March 9, 2023, Tesla’s share price was $949.47, up from $179.88 five years ago.

Despite its impressive growth, Tesla faces some challenges, including increasing competition in the electric vehicle market and concerns about the company’s valuation. Additionally, there are concerns about the company’s ability to scale production to meet demand, with some reports of quality control issues and delays in production.

In conclusion, Tesla is a compelling investment opportunity for those who believe in the company’s growth potential and its focus on innovation and sustainability. With a strong brand and reputation, impressive revenue growth, and a focus on expanding its product line and entering new markets, Tesla is well-positioned for continued success. However, investors should be aware of the company’s challenges, including increasing competition and concerns about its financials, and should carefully consider these factors before investing.